Accounting is the backbone of any business, regardless of its size. For small business owners, managing finances can be a daunting task, especially if they lack accounting expertise. This is where having the right accounting software comes into play.

The right software can help automate financial management, improve working capital management, streamline processes, and provide insights into business performance and track the performance of your revenue model.

In this article, we will explore the best accounting software options for small businesses, considering key features, pricing, and user experience.

Related Read: 15+ Best Accounting Software for all business needs and budgets!

Criteria for Evaluating the Best Accounting Software

Before diving into the top accounting software choices, let’s first discuss the criteria for evaluating the best options for small businesses.

- Ease of use: Small business owners often juggle multiple tasks, so an intuitive and easy-to-use accounting software is crucial. The software should have a user-friendly interface, minimal learning curve, and clear instructions.

- Cost and scalability: Affordability is a significant factor for small businesses. The ideal accounting software should offer various pricing plans to cater to different budgets and business sizes. Scalability is equally important, as the software should grow with the business.

- Integration with other software and tools: A good accounting software should seamlessly integrate with other essential business tools, such as payroll, invoicing, and inventory management systems. This enables the business to have a unified ecosystem and streamlines workflows.

- Customizability and flexibility: Every small business has unique needs. The ideal accounting software should be customizable and flexible enough to accommodate specific requirements, such as creating custom reports, adding unique expense categories, and setting up different tax scenarios.

- Reporting and analytics capabilities: Accounting software should offer comprehensive reporting and analytics features to help small business owners make informed decisions. This includes generating financial statements, tracking cash flow, and identifying trends in revenues and expenses.

- Customer support and resources: Reliable customer support and access to resources are vital when using accounting software. The software provider should offer timely and efficient support through various channels like live chat, phone, and email. Additionally, they should provide helpful resources such as tutorials, webinars, and a knowledge base.

Top Accounting Software for Small Businesses

#1. QuickBooks Online

QuickBooks Online is a popular accounting software choice for small businesses due to its comprehensive features and user-friendly interface. It offers invoicing, expense tracking, time tracking, payroll, inventory management, and financial reporting. It also integrates with various third-party apps, making it a versatile option.

Features of QuickBooks Online

- Invoicing

One of the primary features of QuickBooks Online is its invoicing capabilities. You can create professional, customized invoices with ease, choosing from a variety of templates and incorporating your company logo. With automated invoice reminders, you can ensure timely payments from your customers.

QuickBooks Online also allows for recurring invoices, making it easy to bill clients for ongoing services. Additionally, you can set up and send invoices in multiple currencies, making it suitable for businesses with international clients.

- Expense Tracking

QuickBooks Online simplifies expense tracking by connecting directly to your bank account, credit card, or other financial accounts. This allows for automatic import and categorization of transactions, reducing manual data entry and minimizing errors.

You can also snap and upload pictures of receipts using the QuickBooks mobile app, making it easy to keep track of expenses on the go.

- Bank Reconciliation

Bank reconciliation is a breeze with QuickBooks Online. By connecting your financial accounts, you can easily match transactions and reconcile your accounts, ensuring that your financial records are accurate and up-to-date. The software also helps you identify discrepancies between your bank statements and accounting records, enabling you to resolve any issues promptly.

- Time Tracking

QuickBooks Online allows you to track the time spent on various tasks and projects, which is particularly useful for service-based businesses that bill clients by the hour.

With the integrated time tracking feature, you can log hours worked by employees or contractors, assign time to specific projects, and even generate timesheets for payroll processing. This streamlined approach to time tracking helps improve productivity and ensures accurate billing for your clients.

- Financial Reporting

QuickBooks Online offers robust financial reporting capabilities, providing valuable insights into your business’s financial health. The software generates a wide range of reports, including profit and loss statements, balance sheets, cash flow reports, and accounts receivable and payable aging reports.

These reports can be easily customized and shared with your team or external stakeholders, such as investors or financial advisors.

- Payroll Integration

QuickBooks Online integrates seamlessly with popular payroll solutions like QuickBooks Payroll and third-party providers such as Gusto and ADP. This integration ensures that payroll expenses are accurately recorded in your accounting records, and it simplifies the process of paying employees and managing tax filings.

- Inventory Management

For businesses that deal with physical products, QuickBooks Online offers inventory management features to help you keep track of stock levels, costs, and sales. You can easily add and manage items, set reorder points, and receive notifications when inventory levels fall below a certain threshold.

The software also allows you to track sales trends and identify your best-selling products, enabling you to make data-driven decisions about your inventory strategy.

- Tax Preparation and Filing

QuickBooks Online simplifies tax preparation and filing by automating the calculation of sales tax, payroll tax, and other business-related taxes. You can easily generate tax reports and export the necessary data for filing purposes. QuickBooks Online also keeps up-to-date with the latest tax laws and regulations, helping you stay compliant and avoid penalties.

- Multi-User Access and Collaboration

QuickBooks Online supports multi-user access, allowing you to collaborate with your team, accountant, or bookkeeper in real-time. You can assign different permission levels to users, ensuring that each team member only has access to the relevant information. This feature promotes transparency and accountability in your financial management processes.

- Integration with Third-Party Apps

One of the strengths of QuickBooks Online lies in its ability to integrate with a vast ecosystem of third-party apps, such as CRM systems, e-commerce platforms, and payment processors. These integrations extend the functionality of the software and enable you to create a seamless workflow tailored to your specific business needs.

Pricing and plans of QuickBooks Online

QuickBooks Online offers four pricing plans:

- Simple Start: $30/month

- Essentials: $55/month

- Plus: $85/month

- Advanced: $200/month

Each plan offers different features, catering to various business sizes and needs. They also offer a 30-day free trial for new users. There is currently a 50% discount for three months, so you can get the above plans for half the price.

Pros and cons

Pros:

- User-friendly interface

- Comprehensive features

- Integrates with numerous third-party apps

- Accessible on desktop and mobile devices

- Regular updates and improvements

Cons:

- Some features can be expensive for small businesses

- Limited customization options

#2. Xero

Xero is another popular accounting software option, known for its sleek design and robust feature set. It includes invoicing, bank reconciliation, expense tracking, inventory management, and financial reporting. Xero also supports multi-currency transactions and offers over 800 third-party app integrations.

Features of Xero

- Invoicing: Xero allows you to create professional, customizable invoices and send them to clients. You can set up recurring invoices, accept online payments, and automate invoice reminders.

- Expense Tracking: Connect your bank accounts to Xero for automatic transaction import and categorization. You can also upload pictures of receipts for easy expense tracking.

- Financial Reporting: Xero provides customizable financial reports, including profit and loss statements, balance sheets, and cash flow reports, to help you analyze your business’s financial performance.

- Payroll Integration: Xero integrates with third-party payroll providers, simplifying the process of paying employees and managing tax filings.

- Third-Party App Integrations: Xero offers over 800 integrations with other business tools, such as CRM systems, inventory management platforms, and e-commerce solutions, allowing you to create a seamless workflow tailored to your business needs.

Pricing and plans of Xero

Xero offers three pricing plans:

- Early: $13/month

- Growing: $37/month

- Established: $70/month

Each plan varies in the number of features and limitations. A 30-day free trial is available for new users. Currently each of the plans have a 75% discount for the first three months. The discount applies over these pricing plans.

Pros and cons

Pros:

- Intuitive interface

- Wide range of features

- Over 800 app integrations

- Multi-currency support

Cons:

- No native payroll support (requires integration with a separate payroll app)

- Customer support is primarily through email and online help center

#3. FreshBooks

FreshBooks is an accounting software solution designed specifically for small businesses and freelancers. It offers invoicing, expense tracking, time tracking, project management, and financial reporting.

FreshBooks also has a user-friendly interface and a built-in payment processing feature, allowing clients to pay invoices directly.

Features

- Invoicing: Create and send professional, customizable invoices with FreshBooks. The software also supports online payments, recurring invoices, and automated reminders.

- Expense Tracking: Track expenses by connecting your bank accounts to FreshBooks or manually inputting transactions. The mobile app enables you to capture receipts on the go.

- Time Tracking: FreshBooks allows you to track time spent on projects and tasks, making it easy to bill clients accurately and monitor your team’s productivity.

- Project Management: Collaborate with your team, share files, and track project progress using the built-in project management features.

- Payment Processing: FreshBooks includes a built-in payment processing feature, allowing clients to pay invoices directly through the platform.

Pricing and plans of FreshBooks

FreshBooks offers three pricing plans:

- Lite: $6.80/month (for the first six months and then $17/month)

- Plus: $12/month (for the first six months and then $30 per month)

- Premium: $22/month (for the first six months and then $55 per month

A 30-day free trial is available for new users. There’s also an yearly plan which provides even higher savings.

Pros and cons

Pros:

- Easy-to-use interface

- Built-in payment processing

- Customizable invoice templates

- Strong focus on invoicing and payment collection

Cons:

- Limited inventory management features

- Lacks some advanced accounting features

#4. Zoho Books

Zoho Books is a part of the Zoho ecosystem, offering a comprehensive suite of business applications.

It provides invoicing, expense tracking, bank reconciliation, inventory management, and financial reporting. Zoho Books also supports multi-currency transactions and integrates with other Zoho apps and third-party software.

Features

- Invoicing: Generate professional invoices, set up recurring invoices, and send automated reminders using Zoho Books. The platform also supports multi-currency transactions.

- Expense Tracking: Connect your financial accounts to Zoho Books for automatic transaction import and categorization. You can also upload receipts for efficient expense tracking.

- Financial Reporting: Access customizable financial reports and gain insights into your business’s financial performance with Zoho Books.

- Inventory Management: Manage your inventory, track stock levels, and set reorder points with the software’s inventory management features.

- Integration with Zoho Ecosystem: Zoho Books integrates seamlessly with other Zoho applications, such as Zoho CRM and Zoho Projects, creating a unified business management ecosystem.

- Third-Party App Integrations: The platform supports integration with various third-party business tools, extending its functionality and allowing for a tailored workflow.

Pricing and plans of Zoho Books

Zoho Books offers five pricing plans and even has a free version:

- Standard: $20/month

- Professional: $50/month

- Premium: $70/ month

- Elite: $150/ month

The yearly plan has a lesser monthly charge than the monthly rate. However, if you opt for the yearly plans, you will be billed at one go. A 14-day free trial is available for new users.

Pros and cons

Pros:

- Affordable pricing

- Integration with Zoho ecosystem and other third-party apps

- Multi-currency support

- User-friendly interface

Cons:

- Limited payroll functionality (requires integration with a separate payroll app)

- May not be suitable for businesses with complex accounting needs

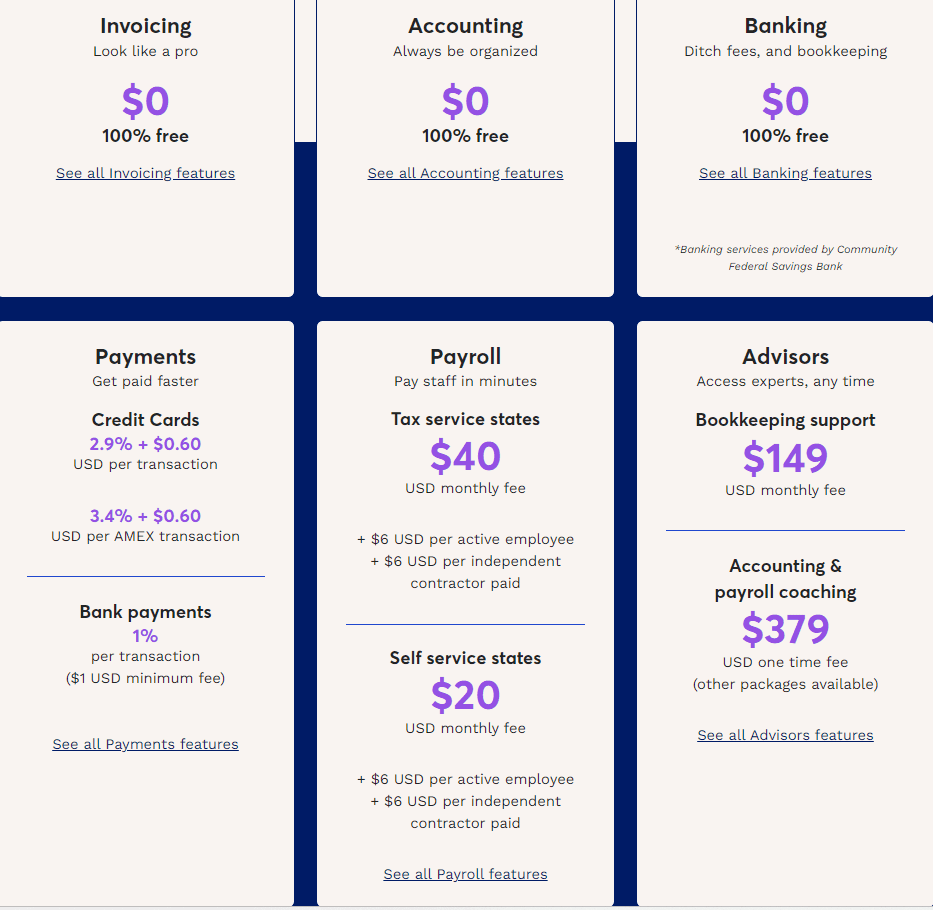

#5. Wave

Wave is a free accounting software option for small businesses and freelancers. It offers invoicing, expense tracking, receipt scanning, and basic financial reporting. While it lacks some advanced features found in paid solutions, it’s an excellent option for businesses with simple accounting needs.

Features of Wave

- Invoicing: Create and send professional invoices with Wave’s customizable templates. The platform also supports recurring invoices and automatic payment reminders.

- Expense Tracking: Connect your bank accounts to Wave for automatic transaction import and categorization. You can also manually input transactions and upload receipts.

- Financial Reporting: Access basic financial reports, such as profit and loss statements and balance sheets, to gain insights into your business’s financial performance.

- Payment Processing: Wave offers integrated payment processing, allowing clients to pay invoices directly through the platform. Note that payment processing fees apply.

- Payroll Services: While Wave’s core accounting features are free, it offers additional paid services such as payroll processing.

Pricing and plans of Wave

Wave’s core accounting features are free, but it does offer additional paid services such as credit card processing and payroll.

Pros and Cons

Pros:

- Free to use

- Simple and easy-to-use interface

- Suitable for businesses with basic accounting needs

Cons:

- Limited features compared to paid options

- No inventory management

- Limited integrations with third-party apps

Specialized Accounting Software for Specific Industries

Some small businesses may require specialized accounting software tailored to their specific industry needs. Here are a few examples:

Restaurant accounting software

MarketMan: MarketMan is an inventory management and restaurant accounting software that helps streamline operations, track expenses, and manage vendor relationships. It integrates with popular point-of-sale (POS) systems, making it a suitable choice for restaurants and foodservice businesses.

Some of its key features are:

- Inventory Management: Keep track of your inventory levels, set reorder points, and manage vendor relationships with MarketMan’s inventory management features.

- Recipe Costing: Calculate the cost of your dishes accurately and monitor your profit margins using the platform’s recipe costing tools.

- Purchase Order Management: Create and manage purchase orders, track deliveries, and oversee supplier relationships with ease.

- Integration with POS Systems: MarketMan integrates with popular point-of-sale (POS) systems, allowing for seamless communication between your front-of-house and back-of-house operations.

Construction accounting software

Buildertrend: Buildertrend is a construction accounting software designed for contractors, remodelers, and home builders. It offers features such as job costing, budgeting, and financial reporting, along with project management and scheduling tools.

Some of the key features are:

- Job Costing: Accurately track your project expenses and ensure profitability with Buildertrend’s job costing tools.

- Budgeting: Create detailed project budgets and track your expenses to ensure you stay on track and within budget.

- Financial Reporting: Generate construction-specific financial reports, such as profit and loss statements by project, to monitor your business’s financial performance.

- Project Management: Collaborate with your team, manage schedules, and track project progress using the platform’s project management features.

- Integration with Other Software: Buildertrend integrates with popular accounting software like QuickBooks and Xero, allowing for seamless data synchronization between your construction and financial management systems.

E-commerce accounting software

QuickBooks Commerce (formerly TradeGecko): QuickBooks Commerce is an inventory and order management software designed for e-commerce businesses. It integrates with popular e-commerce platforms and marketplaces, automates sales and inventory management, and syncs with QuickBooks Online for seamless accounting.

Key features of QuickBooks Commerce include:

- Inventory Management: Manage your inventory across multiple sales channels and warehouses with QuickBooks Commerce’s advanced inventory management features.

- Order Management: Automate your order processing, track shipments, and manage returns to streamline your e-commerce operations.

- Integration with E-commerce Platforms: The platform integrates seamlessly with popular e-commerce platforms like Shopify, WooCommerce, and Amazon, allowing for centralized inventory and order management.

- Accounting Sync: QuickBooks Commerce syncs with QuickBooks Online, ensuring that your financial records are up-to-date and accurate.

Wrapping it Up

Choosing the right accounting software for your small business depends on your industry, unique needs, budget, and desired features. This comprehensive review of the best accounting software options should help you make an informed decision.

We have rated them as per our unique preference as well as secondary data including ratings by the public. Feel free to contrast the features you require against the tools in our review and go for it. All these software have been tried and tested and will surely be useful for your needs.

By selecting one of these accounting tools, you can streamline your financial management, gain valuable insights into your business performance and ultimately, save time and resources to focus on growing your business.

If you have any questions, feel free to drop your comments and I’ll get back to you!

Read Next:

- Best Sales Outreach Tools in 2023

- How the Banking and Finance Sector is being Revolutionised by Smart Contracts: A Study!

- Best Business Intelligence Tools

- 9 Best Cloud-based HR Software Solutions

- WordPress Web Hosting by Convesio: How Good is Convesio? (Review)

- HubSpot CRM Review: Should You Use It?

- Zapier Review: Is It Right for Your Business?

- The Ultimate Marketing Toolkit: Choose from over 231+ Marketing tools and software

- 9 Best Account-based Marketing tools: Which one should you go for?