Fundraising Tracker

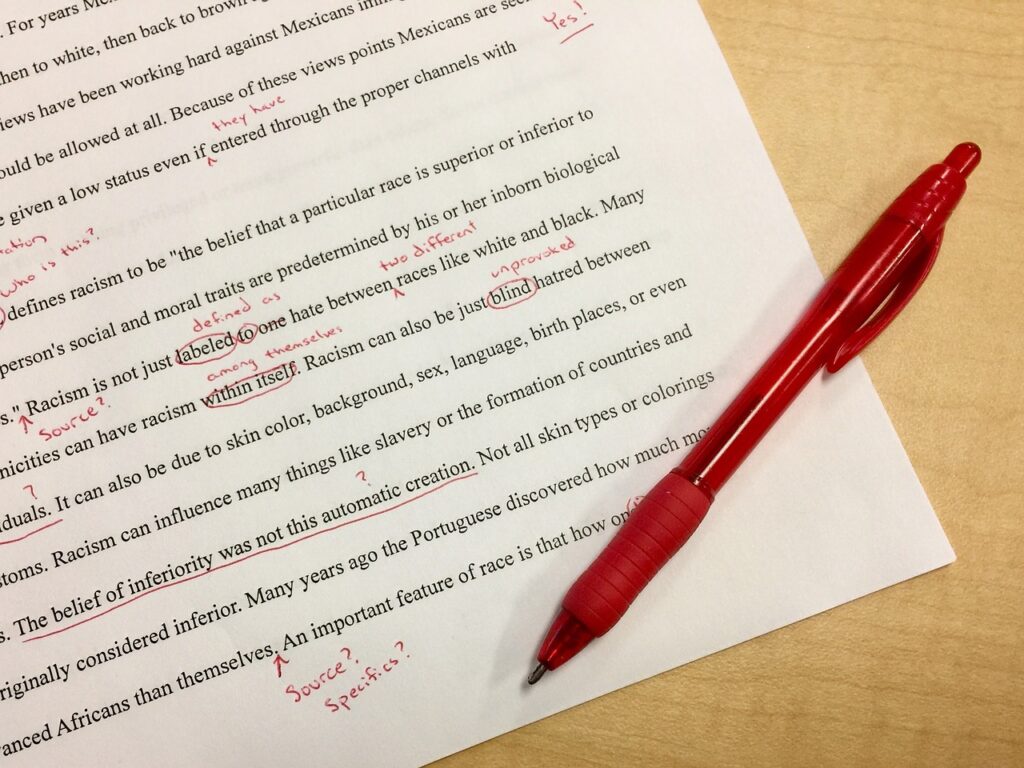

Tracking Details

Funding Rounds Visualization

Investor Interactions Visualization

Starting a new business is an exciting adventure filled with numerous challenges and opportunities. One of the most crucial aspects of building a successful startup is securing the necessary funds to fuel your growth.

This is where fundraising comes into play. However, managing investor interactions, tracking funding rounds, and keeping all related documents organized can be overwhelming.

That's why we've created the ultimate Fundraising Tracker Tool to simplify this process for you. In this article, we'll guide you through how to use this tool effectively and share some valuable tips on mastering your startup's fundraising efforts.

Understanding the Importance of Fundraising

Fundraising is the lifeblood of any startup. Without sufficient capital, it's nearly impossible to scale your operations, develop new products, or expand your market reach. Securing funds allows you to hire the right talent, invest in marketing, and improve your infrastructure. Essentially, it gives you the resources needed to turn your vision into reality.

However, fundraising is not just about getting money. It's also about building relationships with investors who can provide valuable advice, mentorship, and networking opportunities. Therefore, maintaining a structured and organized approach to fundraising is essential.

Introducing the Fundraising Tracker Tool

Our Fundraising Tracker Tool is designed to help startups streamline their fundraising activities. This tool allows you to keep track of investor interactions, monitor funding rounds, and store all related documents in one place. By using this tool, you can ensure that no detail is overlooked, and you can focus on what truly matters—growing your business.

Features of the Fundraising Tracker Tool

Let's take a closer look at the key features of the Fundraising Tracker Tool and how they can benefit your startup.

1. Investor Interactions

Managing relationships with investors is crucial for successful fundraising. Our tool enables you to record every interaction with potential and existing investors. This includes meetings, calls, emails, and other communications. By keeping detailed notes, you can refer back to previous conversations and ensure that you follow up appropriately.

How to Use:

- Add Investor Interactions: Enter the investor's name, interaction date, and any notes from your conversation.

- Review History: Access a comprehensive history of all interactions with each investor, helping you maintain a personal and professional relationship.

2. Funding Rounds

Tracking funding rounds is essential to understanding your financial health and planning for the future. The Fundraising Tracker Tool allows you to log details about each funding round, including the amount raised, the closing date, and the round name (e.g., Seed, Series A).

How to Use:

- Add Funding Rounds: Input the round name, amount raised, and closing date.

- Monitor Progress: Keep an eye on the total funds raised and compare it to your funding goals.

3. Fundraising Documents

Organizing fundraising documents can be a hassle, especially when dealing with multiple investors and funding rounds. Our tool provides a centralized location to store and manage all important documents, such as pitch decks, term sheets, and investment agreements.

How to Use:

- Upload Documents: Add the document name and a link to the file.

- Access Anytime: Quickly retrieve any document when needed, ensuring you always have the necessary information at your fingertips.

Tips for Effective Fundraising

While the Fundraising Tracker Tool is a powerful asset, there are several best practices you should follow to maximize your fundraising success.

Build a Compelling Pitch

Your pitch is your chance to make a strong first impression on potential investors. It should clearly convey your business idea, market opportunity, competitive advantage, and financial projections. Practice delivering your pitch confidently and be prepared to answer any questions.

Network Strategically

Building a robust network is key to finding the right investors. Attend industry events, join startup communities, and leverage social media to connect with potential investors. Remember, relationships take time to develop, so start networking early.

Be Transparent

Investors appreciate transparency. Be open about your business's strengths and weaknesses, and provide accurate and up-to-date information. Honesty builds trust and can lead to long-term partnerships.

Understand Your Valuation

Knowing the value of your startup is critical when negotiating with investors. Conduct a thorough valuation analysis to determine a fair and realistic valuation. This helps you secure the best terms for your funding rounds.

Follow Up Diligently

After initial meetings or pitches, follow up with investors to keep the conversation going. Use the notes section in the Fundraising Tracker Tool to remind yourself of key points discussed and personalize your follow-up messages.

Creating a Fundraising Timeline

Planning and maintaining a timeline for your fundraising activities is crucial. This timeline helps ensure that you stay on track and meet your funding goals within the desired timeframe.

Setting Milestones

Identify key milestones in your fundraising journey. These could include target dates for initial investor outreach, pitch presentations, and closing funding rounds. By setting and tracking these milestones, you can monitor your progress and make adjustments as needed.

Managing Deadlines

Fundraising often involves multiple deadlines. These include dates for submitting documents, following up with investors, and finalizing agreements. Use the Fundraising Tracker Tool to set reminders for these deadlines, ensuring you never miss an important date.

Evaluating Progress

Regularly evaluate your progress against your fundraising timeline. Are you meeting your milestones? Are there any delays? Adjust your plans accordingly to stay on track and keep your fundraising efforts moving forward.

Engaging with Different Types of Investors

Different types of investors can offer unique benefits and challenges. Understanding how to engage with each type can improve your fundraising strategy.

Angel Investors

Angel investors are individuals who provide capital for startups in exchange for equity. They often invest in early-stage companies and can provide valuable mentorship and advice.

Engagement Tips:

- Personalize your approach. Angel investors appreciate a personal connection.

- Highlight your passion and vision. Angels are often motivated by the founder's drive and enthusiasm.

Venture Capitalists

Venture capitalists (VCs) are firms that invest in startups with high growth potential. They typically provide larger amounts of capital than angel investors.

Engagement Tips:

- Focus on scalability. VCs are interested in startups that can grow rapidly.

- Be prepared with detailed financial projections. VCs conduct thorough due diligence.

Corporate Investors

Corporate investors are companies that invest in startups to gain strategic advantages, such as access to new technologies or markets.

Crowdfunding Platforms

Crowdfunding involves raising small amounts of money from a large number of people, typically via online platforms. This can be an effective way to generate capital while also building a community around your product or service.

Engagement Tips:

- Create a compelling campaign. Use engaging visuals, videos, and storytelling to attract backers.

- Offer rewards or incentives. Provide tiered rewards based on contribution levels to encourage higher donations.

Navigating Legal and Compliance Issues

Fundraising is not just about getting money—it's also about adhering to legal and regulatory requirements. Understanding and navigating these issues is crucial to avoid potential pitfalls.

Understanding Securities Laws

Securities laws govern how startups can raise capital. These laws vary by jurisdiction but generally include regulations on how you can solicit investments and what information you must disclose to investors. It's essential to comply with these laws to avoid legal trouble.

Key Considerations:

- Know your exemptions. Certain types of fundraising activities may be exempt from some securities regulations. For example, Regulation D in the U.S. allows startups to raise money from accredited investors without registering with the SEC.

- Provide necessary disclosures. Ensure you provide all required information to investors, such as financial statements and risk factors.

Drafting Investment Agreements

Investment agreements are legal contracts between your startup and investors. These documents outline the terms of the investment, including the amount of equity given in exchange for capital, investor rights, and exit conditions.

Key Considerations:

- Consult a lawyer. Investment agreements can be complex, so it's wise to work with an attorney who specializes in startup law.

- Be clear and specific. Ensure the terms are clearly defined and leave no room for ambiguity.

Intellectual Property Protection

Protecting your intellectual property (IP) is crucial when seeking investments. Investors want to know that your ideas, products, and technologies are protected from competitors.

Key Considerations:

- Secure patents, trademarks, and copyrights. Ensure your IP is legally protected to prevent others from copying or stealing your ideas.

- Document your IP. Keep detailed records of your IP, including when and how it was developed.

Preparing for Investor Due Diligence

Due diligence is the process by which investors investigate your startup to assess its viability and potential for return on investment. Preparing thoroughly for this process can significantly increase your chances of securing funding.

Organizing Financial Records

Investors will want to see detailed financial records, including income statements, balance sheets, and cash flow statements. Make sure these documents are accurate, up-to-date, and well-organized.

Key Considerations:

- Use accounting software. Tools like QuickBooks or Xero can help you maintain accurate financial records.

- Work with an accountant. A professional accountant can ensure your financial statements comply with standard accounting practices.

Demonstrating Traction

Traction refers to evidence that your startup is gaining momentum and achieving growth. This can include metrics like revenue growth, customer acquisition, and user engagement.

Key Considerations:

- Collect and present data. Use graphs, charts, and other visual aids to clearly show your startup's progress.

- Highlight key achievements. Showcase significant milestones, such as reaching a certain number of users or securing major partnerships.

Showcasing Your Team

Investors invest in people as much as they invest in ideas. Highlight the strengths and qualifications of your team members to demonstrate that you have the skills and experience necessary to succeed.

Key Considerations:

- Include bios and resumes. Provide detailed bios and resumes for key team members, highlighting their relevant experience and accomplishments.

- Emphasize team dynamics. Explain how your team works together and how each member contributes to the startup's success.

Developing a Post-Funding Strategy

Securing funds is just the beginning. Developing a clear plan for how you will use the funds and manage your business post-funding is crucial for long-term success.

Allocating Funds Wisely

Careful planning and budgeting are essential to ensure that you use the funds effectively. Develop a detailed plan for how you will allocate the funds across different areas of your business.

Key Considerations:

- Prioritize critical areas. Focus on the areas that will have the most significant impact on your growth, such as product development, marketing, and hiring.

- Monitor spending. Keep track of your expenses and adjust your budget as needed to stay on track.

Communicating with Investors

Maintaining regular communication with your investors is essential. Keep them informed about your progress, challenges, and how you are using the funds.

Key Considerations:

- Provide regular updates. Send regular updates to your investors, such as monthly or quarterly reports.

- Be transparent. Be honest about any challenges or setbacks you face, and explain how you plan to address them.

Setting Milestones and Goals

Establishing clear milestones and goals helps you stay focused and measure your progress. These milestones should align with your overall business strategy and funding objectives.

Key Considerations:

- Define specific, measurable goals. Ensure your goals are clear, achievable, and time-bound.

- Celebrate achievements. Recognize and celebrate when you reach key milestones to keep your team motivated and engaged.

Leveraging Technology for Fundraising Success

In today's digital age, technology plays a crucial role in fundraising. Leveraging the right tools and platforms can streamline your efforts and improve your chances of success.

Using CRM Software

Customer relationship management (CRM) software can help you manage your interactions with potential and existing investors. Tools like Salesforce or HubSpot can help you track communications, set reminders, and manage your fundraising pipeline.

Key Considerations:

- Choose the right CRM. Select a CRM that fits your needs and budget.

- Integrate with other tools. Ensure your CRM integrates with other tools you use, such as email marketing or accounting software.

Utilizing Social Media

Social media platforms can be powerful tools for networking and promoting your fundraising efforts. Platforms like LinkedIn, Twitter, and even Facebook can help you connect with potential investors and share your startup's story.

Wrapping it up

Raising funds for your startup is a complex and challenging process, but it doesn't have to be overwhelming. With the right tools and strategies, you can manage your fundraising efforts effectively and increase your chances of success.

Our Fundraising Tracker Tool provides a comprehensive solution to keep all your fundraising activities organized. By using this tool, you can maintain strong relationships with investors, track your funding progress, and ensure that all necessary documents are easily accessible.

Remember, successful fundraising is about more than just securing money. It's about building partnerships, gaining valuable insights, and setting your startup on the path to long-term success. Start using the Fundraising Tracker Tool today and take control of your fundraising journey. Your startup's future depends on it.