Under the Companies Act, 2013 of India, the terms “subsidiary company” and “holding company” are defined under Sections 2(87) and 2(46) respectively.

For international entrepreneurs and businesses looking to capitalize on the opportunities in India or elsewhere, setting up a company in the US or the UK can provide a strategic advantage.

Firstbase allows you launch your USA-based company from your home country, no matter where you are in the planet. Pay once to access every benefit and service your business needs, including banking and making transactions in USD, Lifetime tax and legal support and managing all paper mail digitally.

1stFormations offers comprehensive company formation packages tailored for non-residents, making it simpler to establish your business presence. With services ranging from registered office addresses to VAT registration, the Non-residents Package is particularly advantageous for those without a UK address. It’s designed to meet all your initial business needs while ensuring compliance with UK regulations. Explore the eSeller and Prestige packages for an all-inclusive solution that covers your company registration and essential services at a discounted rate.

What is a Subsidiary Company? (Section 2(87))

A subsidiary company is a company in which the holding company:

(i) controls the composition of the board of directors; or (ii) exercises or controls more than one-half of the total voting power either at its own or together with one or more of its subsidiary companies.

Such control over the board of directors means that the holding company has the power to appoint or remove all or the majority of directors without the consent or concurrence of any other person. For the purpose of this clause, a company shall be deemed to be a subsidiary company of the holding company even if the control is of another subsidiary company of the holding company.

Further, a company is also considered a subsidiary of the holding company if it is a subsidiary of: (i) a subsidiary of its holding company; or (ii) a continuing subsidiary of its holding company in case the holding company ceases to be a shareholder in the company.

It’s also important to note that any company that is a subsidiary of a company, which is itself a subsidiary of the holding company, is also considered a subsidiary of that holding company.

What is a Holding Company? (Section 2(46))

A holding company, with respect to another company, is a company of which that other company is a subsidiary. As stated above, a company is a subsidiary of a holding company if the latter company controls the composition of its board of directors, or holds or controls more than half of the voting power of the company either at its own or together with one or more of its subsidiary companies.

This relationship between a holding company and its subsidiaries allows the holding company to control and direct the operations of the subsidiary, which can be beneficial for business strategies that involve the management of multiple companies.

In summary, the concepts of subsidiary and holding companies are crucial for understanding the structure of business organizations and the complexity of their interrelationships. The Companies Act, 2013, provides specific criteria to determine these relationships and their implications for corporate governance and control.

How Subsidiaries and Holding Companies can deal with each other?

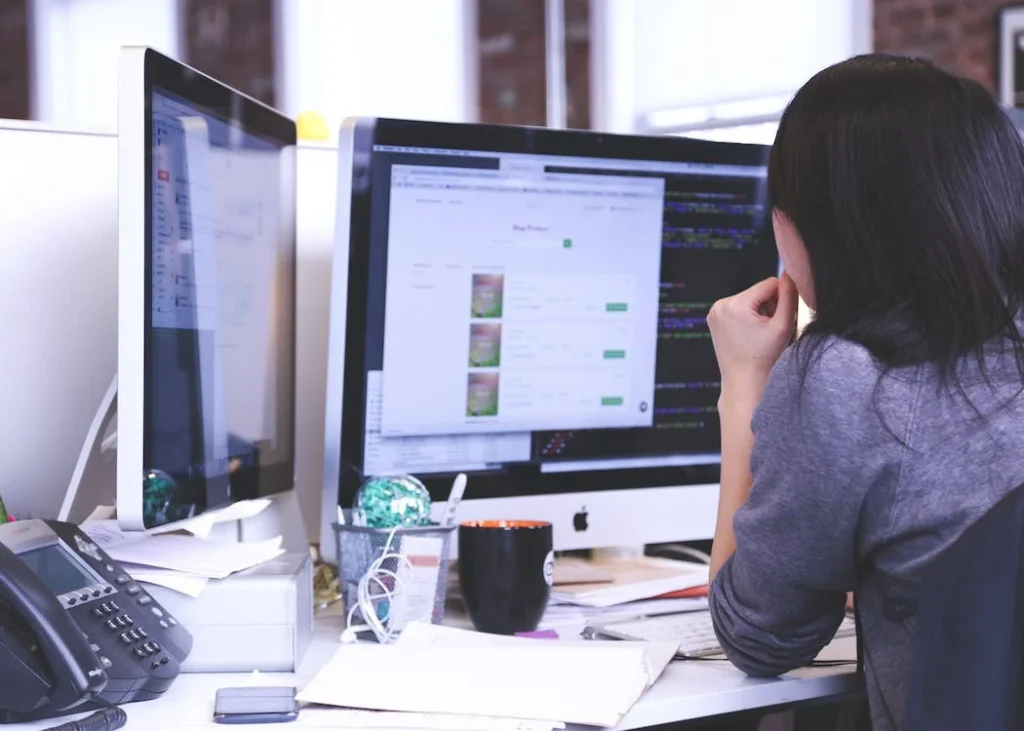

there are several restrictions on transactions between a holding company and its subsidiary as per the Companies Act, 2013 in India. These restrictions are primarily designed to prevent potential conflicts of interest and to protect the interests of shareholders and creditors.

- Section 188: This section of the Companies Act, 2013, governs related party transactions, which would include transactions between a holding company and its subsidiary. This section requires that certain types of transactions (such as sale or purchase of goods, leasing of property, availing or rendering of services, etc.) between related parties must be approved by the board of directors and, in certain cases, by the shareholders through a special resolution.

- Section 185: This section prohibits a company from giving loans, providing any guarantee, or giving security in connection with a loan to any of its directors, or to any other person in whom the director is interested. This prohibition extends to the holding company providing loans to its subsidiary if the director of the holding company is also a director or member of the subsidiary.

- Section 186: This section places restrictions on a company’s ability to make loans and investments or give guarantees or provide security to other companies. This could include loans or guarantees provided by a holding company to its subsidiary. The law requires that the company cannot give loans or guarantees exceeding 60% of its paid-up share capital, free reserves and securities premium account, or 100% of its free reserves and securities premium account, whichever is more. Any loan or guarantee beyond this limit requires prior approval by a special resolution passed in a general meeting.

These rules are aimed to ensure that the resources of the company are used judiciously and in the best interests of all stakeholders.