(This Article has been revised, edited and added to, by Poulomi Chakraborty.)

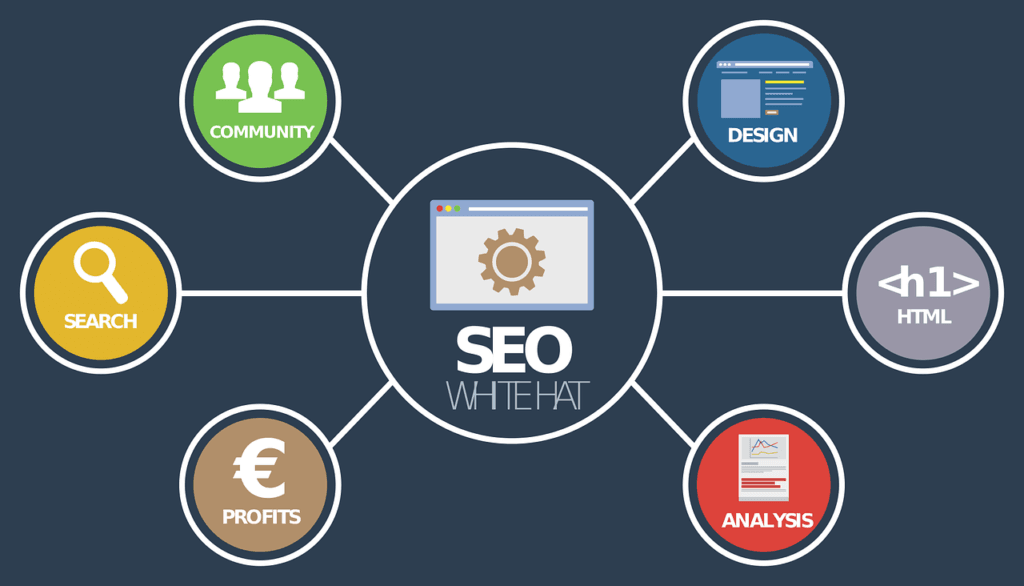

In the competitive landscape of financial planning, standing out as an expert in the field is not just about having the right qualifications; it’s about conveying your expertise effectively to a broad audience. SEO (Search Engine Optimization) plays a pivotal role in establishing your authority in the online space. In this guide, we will journey through the critical SEO strategies that can bolster your reputation as a go-to financial planner. Let’s embark on this transformative journey.

Understanding Your Unique Value Proposition

Before venturing into the dynamic world of SEO, it is imperative to have a grasp of your unique value proposition. This section delves into understanding and articulating what sets you apart in the financial planning landscape.

- Personal Branding: Leveraging personal branding to accentuate your strengths and unique qualities.

- Client Testimonials: Utilizing client testimonials to build trust and showcase your expertise.

Crafting a Compelling Value Proposition

Your value proposition is the cornerstone of your brand, representing the unique value you deliver to your clients that no one else can. In the realm of financial planning, where services can often seem homogeneous to the outside eye, distinguishing your offerings with a clear, compelling value proposition is paramount. This necessitates a deep dive into the core of what makes your service truly unique. Is it your unparalleled expertise in a niche area of financial planning? Or perhaps your innovative approach to client engagement and financial education? Identifying and articulating these unique aspects will set the foundation for all your marketing and SEO efforts.

Integrating Storytelling into Your Brand

Storytelling is a powerful tool that can transform your value proposition from a mere statement into an engaging narrative that resonates with your audience. Humans are naturally drawn to stories; they help us understand complex information and evoke emotional connections. Start by sharing your journey into the financial planning world, including the challenges you’ve faced and the successes you’ve achieved.

This doesn’t just humanize your brand; it illustrates your resilience, expertise, and dedication to your craft. Moreover, incorporate client success stories (anonymously, if necessary) to demonstrate the real-world impact of your services. These narratives should weave through your digital content, from your website to your social media platforms, providing a consistent and compelling brand story that captivates and retains audience attention.

Leveraging Digital Platforms for Enhanced Visibility

In today’s digital age, your online presence is a critical component of your value proposition. Potential clients will likely encounter your brand for the first time online, so it’s essential to ensure that your digital footprint reflects the quality and uniqueness of your services. Optimize your website not just for SEO, but for storytelling and user experience.

High-quality, engaging content that aligns with your value proposition can significantly increase your website’s attractiveness to both users and search engines. Furthermore, actively participate in social media and professional networks to amplify your visibility and establish your reputation as a thought leader in the financial planning space.

Positioning Yourself as a Solution Provider

Ultimately, your value proposition should position you not just as a service provider, but as a solution provider. This means going beyond just listing your services or accolades. It involves demonstrating a deep understanding of your clients’ needs, challenges, and aspirations, and showing how your unique approach can address these.

Tailor your content to speak directly to these needs, using language and examples that resonate with your target audience. By positioning yourself as an indispensable resource for financial planning and wealth management, you enhance your value proposition and differentiate your brand in a competitive market.

Continuous Evaluation and Adaptation

The financial world is ever-changing, and so are the needs and preferences of your clients. An effective value proposition is not set in stone; it requires continuous evaluation and adaptation to remain relevant and compelling. Stay informed about industry trends, regulatory changes, and emerging client needs. Use these insights to refine your value proposition and ensure that your brand remains at the forefront of the financial planning industry.

Building a Knowledge-Infused Content Strategy

A well-rounded content strategy infused with knowledge is at the heart of SEO. In this segment, we will explore the various content avenues that can showcase your expertise effectively.

- Educational Blogs: Creating educational blogs that offer value and insights to your audience.

- Whitepapers and Case Studies: Developing in-depth whitepapers and case studies to demonstrate your industry knowledge.

Mastering the Art of Knowledge-Infusion in Content Creation

In the fast-evolving financial planning landscape, a knowledge-infused content strategy is your beacon. It guides potential clients through the complexity of financial decisions with clarity and authority. Beyond merely populating your site with content, this strategy entails crafting information-rich, engaging materials that highlight your expertise, answer pressing client questions, and illuminate the path to their financial goals.

Diversifying Content Formats for Broader Reach

To truly resonate with a diverse audience, financial planners must look beyond traditional blog posts and articles. The digital era demands a multifaceted approach to content creation, where the value is delivered through various formats to cater to different preferences and learning styles.

Embracing the Power of Video Content

Video content stands out as a highly effective medium to break down complex financial concepts into digestible, engaging narratives. Platforms like YouTube provide a vast stage to showcase your expertise, share client success stories, and host live Q&A sessions. These visual stories can significantly increase engagement, making intricate topics accessible and captivating to a wider audience.

Leveraging Podcasts for Thought Leadership

Podcasts offer a unique avenue to establish thought leadership in the financial planning domain. By discussing industry trends, offering financial tips, and interviewing other experts, you can create a loyal listenership that values your insights. Podcasts not only enrich your content mix but also fit seamlessly into the busy lifestyles of your target audience, allowing them to consume valuable information on the go.

Interactive Tools and Calculators

Offering interactive tools and calculators on your website can significantly enhance user engagement. These resources help clients understand their financial situations better, simulate different scenarios, and appreciate the value of professional financial planning. From simple budget planners to complex investment return calculators, these tools empower users, driving home the message that you are invested in their financial well-being.

SEO Optimization Beyond Keywords

While keywords form the backbone of SEO, the evolving algorithms of search engines like Google now prioritize the user experience and the richness of content offered. This shift demands a more nuanced approach to SEO, where the focus is broadened to include:

Enhancing Readability and User Engagement

Craft content that is not only informative but also engaging and easy to read. Use headings, subheadings, and bullet points to break down information, making it accessible at a glance. Incorporate relevant images, infographics, and videos to complement your text, increasing the time visitors spend on your site—a key metric for SEO success.

Structuring Content for Featured Snippets

Google’s featured snippets provide direct answers to users’ queries right at the top of the search results. By structuring your content to answer specific questions concisely and clearly, you increase the chances of your content being selected for these snippets, thereby boosting your visibility and authority.

Creating a Content Ecosystem

An effective content strategy for financial planners transcends creating standalone pieces of content. It involves building a content ecosystem where every piece interconnects, leading users on a journey that deepens their understanding and engagement with your brand.

Building Topic Clusters

Organize your content into topic clusters around core subjects, with a pillar page that provides a comprehensive overview of the topic and several related but more specific articles linked back to it. This not only helps users navigate your content more effectively but also signals to search engines the breadth and depth of your expertise, enhancing your SEO performance.

Encouraging User-Generated Content

Invite your audience to contribute to your content ecosystem through comments, forums, or guest posts. User-generated content not only enriches your content offering but also fosters a sense of community. It provides fresh perspectives and keeps your content dynamic, further bolstering your SEO efforts by signaling that your site is active and valued by its users.

Incorporating these strategies into your content creation process transforms it from a mere SEO tactic into a comprehensive approach to establishing authority, engaging your audience, and driving meaningful interactions. Through a diverse range of formats, a focus on user experience, and the creation of an interconnected content ecosystem, financial planners can craft a content strategy that not only ranks well in search engines but also genuinely serves and resonates with their target audience.

Keyword Strategy to Showcase Expertise

In this section, we delve into creating a keyword strategy centered around your expertise, targeting keywords that highlight your proficiency and experience in financial planning.

- Long-Tail Keywords: Leveraging long-tail keywords that resonate with individuals seeking expert financial advice.

- Keyword Mapping: Engaging in keyword mapping to organize your content effectively and improve SEO.

Understanding the Nuances of Keyword Integration

In the intricate world of SEO, the strategic use of keywords is akin to laying down a map for potential clients to find your financial planning services. However, the art of keyword strategy extends beyond mere integration; it’s about embedding your expertise within each search term, creating a seamless bridge between what your audience seeks and what you offer.

The Psychology Behind Keyword Selection

Tapping into Client Intent

To elevate your keyword strategy, begin by delving deep into the psychology of your prospective clients. Understand not just what they search for, but why they initiate these searches. This insight allows you to tailor your keywords not just to their queries but to their underlying intentions—be it seeking advice on retirement planning, understanding investment options, or finding ways to save for college. By aligning your keywords with client intent, you create content that resonates on a deeper level, effectively attracting a more engaged audience.

Semantic Search and User Experience

Embrace the complexity of semantic search, where the context and the relationship between words matter just as much as the keywords themselves. This approach involves crafting content that naturally answers the questions your audience is asking, even if they don’t use specific keywords. By focusing on topics and themes relevant to your expertise, you enhance the user experience and improve your visibility in search results that rely on natural language processing and the intent behind searches.

Advanced Keyword Research Techniques

Leveraging Competitor Analysis

Competitor analysis is a goldmine for refining your keyword strategy. Investigate the keywords your competitors rank for, especially those that drive significant traffic to their sites. Tools like SEMrush or Ahrefs can provide these insights, revealing gaps in your own content strategy and opportunities to differentiate your brand. However, the goal is not to mimic but to innovate, finding unique angles and untapped niches that align with your expertise.

Exploring Long-Tail Keywords in Niche Markets

The power of long-tail keywords in the financial planning industry cannot be overstated. These longer, more specific phrases often have lower search volumes but signify a higher intent, leading to more qualified traffic. For financial planners, this might mean focusing on niche areas of expertise, such as “tax strategies for freelance workers” or “estate planning for digital assets.” These detailed queries open doors to audiences actively seeking your specialized knowledge, allowing for more personalized and impactful engagement.

Crafting a Dynamic Keyword Strategy

The Role of Content Silos in Organizing Keywords

Consider organizing your site content into content silos, a strategy that groups related content together to create a structured hierarchy. This method not only improves site navigation for users but also enhances your SEO by clearly defining areas of expertise. Within each silo, use a mix of broad and long-tail keywords to capture a wide range of search intents, reinforcing your authority on specific topics within financial planning.

Adaptive Keyword Optimization

The digital landscape is ever-evolving, and so are the ways people search for financial advice. An effective keyword strategy is not static; it requires constant adaptation to changing market trends, client needs, and search engine algorithms. Regularly review your keyword performance, staying agile and ready to pivot your content to address emerging trends and questions. This proactive approach ensures your content remains relevant and your expertise visible, regardless of how the digital winds shift.

By deepening your understanding of client intent, leveraging advanced research techniques, and crafting a dynamic keyword strategy, you solidify your standing not just as a financial planner but as a trusted advisor in the digital age. Through thoughtful keyword selection and strategic content organization, you guide your audience through the complexities of financial planning, turning searches into meaningful engagements and inquiries into lasting client relationships.

SEO Technicalities to Enhance User Experience

SEO is not just about content; it’s about offering a seamless user experience. Here, we discuss the behind-the-scenes SEO technicalities that can enhance user experience and promote engagement.

- Website Speed: Ensuring a fast website speed to facilitate a smooth browsing experience for your visitors.

- Mobile Optimization: Optimizing your website for mobile users to cater to the substantial portion of internet users who prefer browsing on their phones.

The Intersection of SEO and User Experience

In the realm of digital marketing, SEO and user experience (UX) are intertwined, each influencing the success of the other. For financial planners seeking to make an indelible mark online, understanding this symbiosis is crucial. A stellar user experience enhances SEO performance by signaling to search engines that your website is valuable, thereby improving rankings. Conversely, effective SEO practices can lead users to the quality content and services they seek, thereby enhancing their experience on your site.

Advanced On-Page SEO Techniques

Enhancing Site Structure for Better Crawling and Indexing

The foundation of a great user experience is a website that’s easily navigable not just by users but by search engines too. A logical, hierarchical site structure ensures that search engines can crawl and index your content efficiently. Implement a clear, intuitive navigation system with a well-defined menu, straightforward categories, and a sitemap that guides search engines through your content. This clarity helps users find the information they need quickly and search engines to recognize your site as a well-organized resource.

Schema Markup: Communicating with Search Engines

Schema markup is a powerful tool that communicates directly with search engines, providing detailed information about your content. By implementing schema markup, you can enhance your search listings with rich snippets, which are visually appealing and provide key information at a glance. For financial planners, this could mean displaying star ratings from client testimonials, upcoming event information, or quick answers to common financial questions. Rich snippets can significantly improve click-through rates by making your listings stand out in the crowded search results.

Prioritizing Mobile Optimization

Crafting a Responsive Design

With the majority of internet traffic now coming from mobile devices, having a responsive website design is no longer optional. A responsive design automatically adjusts your site’s layout to fit the screen on which it’s being viewed, ensuring a seamless user experience across devices. This adaptability not only caters to user preferences but also aligns with Google’s mobile-first indexing, directly impacting your SEO performance.

Accelerating Page Speed on Mobile

Page speed is a critical factor in both user experience and SEO. Slow-loading pages can frustrate users and increase bounce rates, while fast-loading pages are rewarded by search engines with higher rankings. Utilize tools such as Google’s PageSpeed Insights to identify and rectify common issues that slow down your site, such as large images, excessive use of JavaScript, or slow server response times. Implementing best practices for speed optimization, such as image compression and the use of a content delivery network (CDN), can drastically improve your site’s loading time and user satisfaction.

Security and Privacy: Building Trust Through Technical SEO

Implementing HTTPS for a Secure Browsing Experience

In an era where online privacy concerns are at an all-time high, ensuring your website is secure is paramount. Migrating your site to HTTPS, which encrypts data between the user’s browser and your server, signals to both users and search engines that your site is trustworthy and secure. For financial planners, who deal with sensitive financial information, this is particularly crucial. A secure site not only protects your clients’ data but also enhances your reputation and search rankings.

Continuous Testing and Optimization

Leveraging Analytics for Insight-Driven Improvements

The key to sustaining an optimized user experience lies in continuous testing and refinement. Use analytics tools to monitor how users interact with your site, identifying pages with high bounce rates or poor engagement. Conduct A/B testing to compare different layouts, calls to action, and content formats, continually refining your site based on data-driven insights. This iterative process ensures your website remains aligned with user preferences and search engine requirements, solidifying your online presence and authority in the financial planning industry.

By delving into the technicalities of SEO with a focus on enhancing user experience, financial planners can create a digital presence that not only ranks well in search results but also meets the needs and exceeds the expectations of their audience. This holistic approach to SEO fosters a mutually beneficial relationship between your website and its visitors, driving engagement, conversions, and ultimately, the growth of your financial planning practice.

Link Building: Establishing Authority

In this segment, we go through the strategies of link building, a vital element in establishing your website’s authority and improving its search engine ranking.

- Quality Backlinks: Focusing on acquiring quality backlinks that enhance your site’s credibility.

- Guest Blogging: Leveraging guest blogging opportunities to reach a wider audience and establish your expertise.

The Role of Link Building in SEO and Authority Establishment

In the digital landscape, link building is not merely a tactic for enhancing SEO performance; it’s a cornerstone strategy for establishing and amplifying your authority as a financial planner. Links from reputable sites act as endorsements, signaling to search engines that your content is valuable and trustworthy. This section delves into advanced strategies for building a robust link profile that not only boosts your SEO rankings but also cements your reputation as an industry authority.

Crafting High-Quality Content That Attracts Backlinks

Creating Comprehensive Guides and Resources

One of the most effective methods to attract high-quality backlinks is by creating comprehensive guides and resources that serve as definitive sources on specific financial planning topics. These resources should go beyond surface-level advice, offering in-depth analysis, actionable tips, and unique insights that readers won’t find anywhere else. Such content naturally attracts links from other websites, including industry blogs, news outlets, and forums, as they reference your work in their own content.

Utilizing Data and Original Research

Content that includes unique data or findings from original research is highly linkable. Conduct surveys, compile industry statistics, or analyze market trends to create content that offers fresh perspectives on financial planning. Original research not only sets your content apart but also positions you as a thought leader in your field, encouraging others to cite and link to your findings.

Engaging in Community Building and Networking

Participating in Industry Forums and Discussions

Actively participating in online forums and discussions related to financial planning can significantly enhance your link-building efforts. By providing helpful answers and sharing your expertise, you can build relationships within the community. These engagements can lead to natural backlink opportunities when members reference your advice or resources in their own content or on social media.

Hosting and Participating in Webinars and Online Panels

Hosting webinars or participating in online panels are excellent ways to showcase your expertise and connect with peers. These events offer valuable networking opportunities that can result in backlinks from event organizers, participants, and attendees who share content related to the event. Additionally, offering to be a guest speaker on relevant podcasts or interviews can further expand your reach and backlink potential.

Strategic Partnerships and Collaboration

Collaborating with Non-Competing Businesses

Forge partnerships with businesses that offer complementary services to your financial planning practice. For example, collaborating with real estate firms, tax advisors, or legal professionals on content projects can lead to mutual backlinking and referral opportunities. Such collaborations not only diversify your link profile but also introduce your services to a wider audience.

Leveraging Local Associations and Chambers of Commerce

Membership in local associations and chambers of commerce can be a valuable link-building resource. These organizations often feature member directories and highlight member achievements on their websites, providing authoritative backlinks. Participating in community events and sponsorships further increases your visibility and the likelihood of earning links from local media outlets and event organizers.

Prioritizing Ethical Link Building Practices

Avoiding Black-Hat Techniques

In the pursuit of backlinks, it’s crucial to adhere to ethical SEO practices. Avoid black-hat techniques such as buying links, participating in link farms, or using automated programs to generate links. Such practices can result in penalties from search engines, damaging your SEO efforts and reputation. Focus instead on building links organically by offering genuine value through your content and interactions.

By implementing these advanced link-building strategies, financial planners can significantly enhance their digital authority and SEO performance. High-quality content, active community engagement, strategic partnerships, and ethical practices form the pillars of a successful link-building campaign. Together, these elements work synergistically to establish your financial planning practice as a trusted authority in the industry, driving traffic, improving search rankings, and ultimately, contributing to the growth and success of your business.

Related: Check out our free SEO suite

Understanding Your Unique Value Proposition

To carve out a niche in the saturated market of financial planning, it’s crucial to initiate your journey with a robust understanding of your unique value proposition. Let’s unearth the strategies to create a distinctive identity.

Personal Branding

Your journey and experiences in the financial world are the backbone of your personal brand. Craft a compelling narrative that resonates with your target audience. Embark on creating a unique visual branding strategy that includes a distinctive logo, color scheme, and typography that echoes your professional ethos.

Client Testimonials

Encourage your clients to share detailed reviews, narrating their experiences and the transformations they underwent through your financial planning. Leverage video testimonials to create a visually engaging narrative of your client’s success stories, fostering trust and authenticity.

Deepening Client Understanding to Refine Your Value Proposition

Leveraging Client Insights for Competitive Advantage

In the crowded marketplace of financial planning, your unique value proposition (UVP) serves as a beacon, drawing clients to your services. To further refine your UVP, embark on a journey of deep client understanding. Utilize surveys, feedback forms, and one-on-one conversations to uncover the specific needs, challenges, and goals of your target audience. This deeper insight allows you to tailor your services and communication in a way that resonates on a personal level, setting you apart from competitors.

Analyzing Market Trends for Proactive Adaptation

Stay ahead of market trends and regulatory changes within the financial planning industry. By proactively adapting your services and strategies to these shifts, you demonstrate foresight and a commitment to client welfare. This adaptability not only enhances your UVP but also positions you as a thought leader, ready to navigate the complexities of the financial landscape on behalf of your clients.

Enhancing Digital Presence for Amplified Visibility

Maximizing Social Proof through Strategic Online Engagement

Social proof, including client testimonials and success stories, plays a crucial role in reinforcing your UVP. Amplify this aspect by strategically engaging on platforms where your target audience spends their time. Share client success stories, informative articles, and insightful commentaries on social media, professional forums, and your website. Encourage satisfied clients to leave reviews on relevant platforms, further solidifying your reputation as a trusted financial planner.

Embracing Technology to Elevate Client Experience

In an era dominated by digital interactions, your ability to incorporate technology into your service delivery can be a significant differentiator. Offer innovative solutions like mobile apps for financial tracking, online consultation platforms, and interactive tools for financial planning. These technological enhancements not only improve the client experience but also strengthen your UVP by showcasing your commitment to accessibility and modernization.

Cultivating a Brand That Resonates

Building a Cohesive Brand Identity

Your brand identity extends beyond logos and color schemes; it encompasses every interaction clients have with your business. Ensure consistency in your messaging, visual identity, and client experiences to build a strong, recognizable brand. This cohesion makes your financial planning services easily identifiable in the marketplace, reinforcing your UVP and fostering client loyalty.

Storytelling as a Tool for Emotional Connection

Craft a compelling brand story that encapsulates your mission, values, and the journey that led you to financial planning. This narrative should weave through all your communications, from your website to client meetings, creating an emotional connection with your audience. A well-told brand story can transform your UVP from a simple statement of benefits into a resonant message that aligns with the aspirations and values of your clients.

Offering Unparalleled Value Through Education and Empowerment

Providing Value Beyond Financial Planning

Extend the boundaries of your services by offering educational resources, workshops, and seminars that empower your clients to make informed financial decisions. By providing value beyond the traditional scope of financial planning, you enrich your UVP, positioning yourself as not just a service provider but as a partner in your clients’ financial well-being.

Creating a Community of Financial Literacy

Foster a community around financial literacy by hosting events, starting discussion forums, and creating content that encourages interaction among your clients. This community-building effort not only enhances your brand’s visibility and authority but also deepens client engagement with your UVP, as they benefit from a supportive network in addition to individual services.

By strategically enhancing your unique value proposition through deeper client understanding, digital innovation, cohesive branding, and educational empowerment, you can significantly differentiate your financial planning services in the market. This multifaceted approach not only elevates your SEO strategy but also establishes a strong, memorable presence that attracts and retains clients, driving the success and growth of your financial planning practice.

Building a Knowledge-Infused Content Strategy

A repository of knowledge-infused content not only amplifies your online presence but stands testament to your expertise. Let’s explore the avenues to craft content that speaks volumes about your proficiency.

Educational Blogs

Regularly update your audience with the latest industry trends, showcasing your adeptness at staying abreast with the dynamic financial landscape. Develop a series of how-to guides, aiding your audience in navigating the complex financial terrains with ease, thus positioning yourself as a beacon of knowledge.

Whitepapers and Case Studies

Offer your audience an in-depth analysis of prevalent financial issues through well-researched whitepapers, highlighting your deep-seated understanding of the industry. Chronicle the success stories of your clients through detailed case studies, presenting a tangible testimony of your expertise in financial planning.

Embedding Expertise in Every Content Layer

Cultivating Authority with Specialized Topics

To distinguish your content in the financial planning realm, focus on cultivating authority by delving into specialized topics that showcase your unique expertise. This involves not just scratching the surface of general financial advice but exploring niche areas where you can provide unmatched insight. Whether it’s estate planning for digital assets or navigating tax implications for international investments, offering deep dives into these topics demonstrates your comprehensive knowledge and sets you apart as a thought leader.

Leveraging Data and Analytics for Content Precision

Utilize data and analytics to guide your content strategy. By analyzing which topics garner the most interest and engagement from your audience, you can tailor your future content to meet these preferences. Tools like Google Analytics and social media insights can reveal patterns in reader behavior, allowing you to refine your content focus and delivery methods for maximum impact.

Fostering Engagement Through Interactive Content

Engaging Audiences with Interactive Webinars and Q&A Sessions

Amplify engagement by incorporating interactive elements into your content strategy. Hosting live webinars on pressing financial topics or open Q&A sessions where you answer audience questions in real time can significantly boost engagement. These interactive sessions not only provide value but also allow you to connect directly with your audience, building trust and establishing a rapport that static content alone cannot achieve.

Utilizing Visuals and Infographics for Complex Concepts

Financial planning encompasses complex concepts that can be challenging for some clients to grasp. By incorporating visuals, infographics, and even interactive charts into your content, you can break down these complexities into understandable and engaging formats. Visual aids not only enhance comprehension but also increase the shareability of your content across social platforms, extending its reach and impact.

Integrating Client Success Stories and Testimonials

Showcasing Real-world Impact

Integrate client success stories and testimonials into your content strategy to showcase the real-world impact of your financial planning services. These narratives provide tangible evidence of your expertise and the value you bring to clients’ lives. Highlighting diverse success stories also illustrates your ability to cater to various financial needs, further reinforcing your authority and versatility in the field.

Crafting Case Studies for In-depth Analysis

Develop in-depth case studies that detail the journey of a client from their initial financial challenges to the solutions you provided and the outcomes achieved. These case studies not only serve as compelling content but also as educational tools for readers, offering insights into the strategic thinking and personalized approach behind your financial planning services.

Leveraging Content for Community Building

Creating a Platform for Discussion and Exchange

Transform your content into a catalyst for community building by encouraging discussion and exchange among your audience. This can be facilitated through comment sections, forums, or social media groups linked to your content. Providing a platform for your readers to share their experiences, ask questions, and interact with each other fosters a sense of community, enhancing engagement and loyalty to your brand.

Collaborating with Industry Peers for Content Enrichment

Collaborate with other experts in the financial industry to co-create content. This could involve guest blogging, joint webinars, or podcast interviews. These collaborations bring fresh perspectives to your content, broaden its appeal, and introduce your services to a wider audience. Moreover, it demonstrates your commitment to providing comprehensive and diverse insights, further cementing your status as a leader in the financial planning field.

By strategically expanding your content strategy to include specialized topics, interactive elements, real-world success stories, and community-building initiatives, you can significantly enhance the value and appeal of your offerings. This multifaceted approach not only positions you as an authority in financial planning but also deeply engages your audience, laying a solid foundation for lasting relationships and business growth.

Expert Opinion

The finance sector isn’t known for its engagement; let’s be honest, mortgage rates aren’t as shareable as cute cat videos. But I’ve successfully deployed semantic search techniques that capture users’ specific financial queries, seeing an uptick in organic traffic within months. Don’t just target keywords; aim for questions and pain points that your audience has. With localized SEO for mobile banking, we saw an incredible 55% growth in click-through rates. In the finance world, understanding user intent can be more profitable than other niches.

Amanda Sexton Founder, FocusWorks

Industry Specific hack to use:-

E-commerce SEO Strategy:

When it comes to e-commerce, consider implementing schema markup, which adds structured data to product pages, enhancing search results with additional information like product ratings and prices. This not only attracts more clicks but also provides valuable details to potential customers. Ensure that product descriptions go beyond basic information to highlight key features and benefits, making them compelling and informative. Encourage user-generated content, such as customer reviews, to improve credibility and introduce keyword-rich content to enhance SEO.

Local Business SEO Strategy:

Local businesses should prioritize local SEO by optimizing their online listings. Accurate and consistent business information across platforms like Google My Business and Yelp is essential. Seek local backlinks from relevant websites in your area, as these citations boost local search rankings significantly. Actively prompt satisfied customers to leave reviews, as positive feedback influences both potential customers and search visibility. Did you perform any recent experiment that has worked great?

Recent Experiment that has worked:-

Keyword Research and Strategy :

The initial step involved conducting comprehensive keyword research. In this phase, identify a selection of long-tail keywords that hold relevance to your business. The chosen keywords will exhibit a respectable search volume and boast a competitive advantage due to their lower competition with broader and more generic keywords. The keyword research process allowed business owners to pinpoint specific terms and phrases that target what audiences are actively searching for. By prioritizing long-tail keywords, which aimed to capture the attention of a more focused and intent-driven segment of potential customers, enhancing the likelihood of attracting qualified visitors.

Content Revamp and Enhancements:-

Embarking on a comprehensive content overhaul has primary objectives that infuse the long-tail keywords into existing content while upholding the quality, value and informativeness of the material for the audience. This involved creating a cohesive network of links that connected related pages, enhancing navigation for both visitors and search engine crawlers, which aimed to improve the overall SEO of business websites, making them more accessible and relevant to our target audience.

Lisa Rehurek, CEO and Founder of RFP Succees Company

When it comes to SEO in the financial services and banking industry, there are a few tactics that I find particularly effective. One important aspect is to focus on relevant keywords. Conduct thorough keyword research to identify the phrases and terms that potential customers in the industry are searching for. Incorporate these keywords strategically into your website content, including headings, page titles, meta descriptions, and body text. This can help improve your website’s visibility in search engine results. Another effective strategy is to optimize your website for local SEO. Since many financial services and banking institutions have physical locations, it’s important to target local customers. Make sure you include your location information on your website, such as your address, phone number, and business hours. Creating and optimizing Google My Business and other local directory listings can also boost your visibility in local search results.

James Williams, founder of TechPenny

According to me one of the best SEO strategies to improve your rankings and traffic on your site is by optimizing the page title and meta description. The first thing that a visitor observes when he/she searches for something specific is the title of your content and the two to three lines below the title that appears on your site called meta description. The meta description that you are delivering should be attractive, impactful, and unique so that when a visitor comes to your site by seeing your meta description the visitor wishes to read ahead and click your website. More unique description means more traffic which will increase your website’s ranking.

Rebeca Tms, PR Outreach Specialist at Branding Design Pro.

Conclusion

In the dynamic landscape of financial planning, emerging as a beacon of knowledge and expertise is a journey forged through strategic SEO endeavors. As we navigated through the nuanced pathways of crafting a unique value proposition, building a robust content strategy, optimizing keywords, and enhancing user experience, we have equipped you with a multifaceted toolkit to foster a digital presence synonymous with expertise and trust.

However, remember that SEO is not a one-time venture. It is a continuous and evolving journey, much like the field of financial planning itself. As you venture further, nurturing relationships through link building and engaging platforms, you are not just optimizing a website but cultivating a community grounded in trust, knowledge, and mutual growth. But this is not the end; it’s a beautiful beginning. A beginning where every blog post you craft tells a story, every webinar you host builds a connection, and every strategy you implement takes you a step closer to becoming the go-to financial planner.

As you stand on the cusp of this exciting journey, ready to dive into the world enriched with opportunities, remember that the key to SEO success lies in the value you provide. It’s about crafting a narrative of authenticity, diving deep into the intricacies of financial planning with an open heart, and a spirit ready to guide, educate, and nurture.

Read Next

- Impact of Predictive Analytics on Sales Forecasting: A Deep Dive!

- How to use GetResponse: An Explainer!

- How to use Loomly: An In-Depth Explainer

- How to use SocialPilot: An Explainer!

- How to use Sendible: An Explainer

Comments are closed.